Seeking optimism in uncertainty

Grant Thornton’s newly released 2024 Real Estate Outlook Report is now available, with a focus on current trends impacting the Canadian real estate industry.

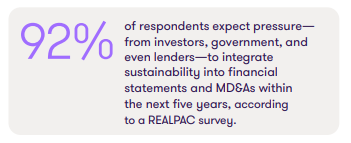

The Canadian real estate industry is taking a ‘wait and see’ approach in 2024 with so much uncertainty surrounding current conditions and the overall economic picture remains unclear. The Grant Thornton 2024 Real Estate Outlook Report1 highlights current trends impacting the real estate industry, including: risk management, development pressures, ESG, and trends across residential, retail, office, industrial, and alternative asset classes.

Our key takeaways:

- Bank of Canada predicts 2.4% growth in 2025 (over 0.8% in 2024)

- The Canadian economy going through a correction period

- Lenders looking to minimize exposure to risk (read: liquidity)

- Canadian real estate industry taking a 'wait and see' approach

- Residential prices may drop, but interest payments have gone up

- Higher household debt + increased interest rates = less sustainable

- Office space demand down, REIT values down 50-60% since 2020

- Industrial asset class remains a strong asset

- Brick & mortar retail rebounding, relatively stable

Read the full report.

The Report Authors

- John Di Liso, Partner, Tax | National Real Estate and Construction Leader

- Patrick McCormack, Partner, Assurance | Southern Ontario Real Estate & Construction

1 Grant Thornton is a member of the Kelowna Chamber of Commerce