On December 14 we joined the Canadian Chamber of Commerce's Chief Economist Stephen Tapp and Senior Director Patrick Gill of their Business Data Lab for a special Quarterly Briefing. The team spoke to some of the key findings from their in-depth analysis of Statistics Canada's Q4 2023 Canadian Survey on Business Conditions, and we had opportunity to hear their insights.

The comprehensive report is more than just data (and we love data); it's a direct line to what Canadian businesses are experiencing and anticipating. The report provides a clear snapshot of their sentiments, challenges, and strategies and serves as a vital resource for understanding sectoral variations, regional disparities, and emerging trends. A few of the key findings that were highlighted included data on CEBA loans, how business sentiment is at a two-year low, labour market dynamics, and more.

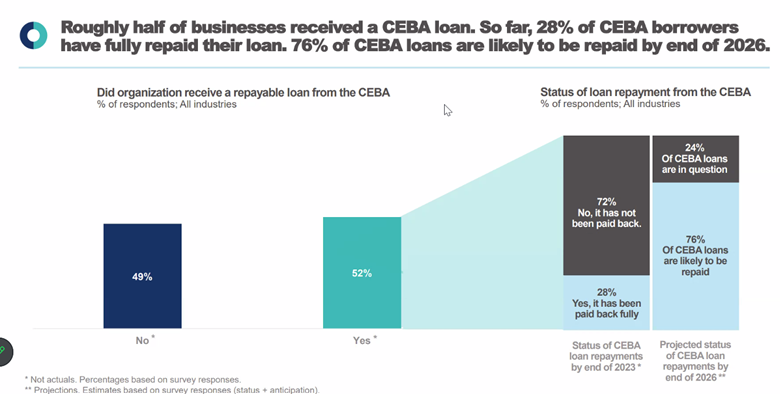

Our Takeaways: CEBA

CEBA loans continue to be a topic of conversation among Canadian businesses; the percentage of businesses reporting a struggle to repay now stands at 24%. Read more from the Canadian Chamber and review the country-wide stats here.

Our Takeaways: Labour & Economy

One recommendation we hear frequently at the Chamber – to improve the pace of new housing construction – is to hire more workers. Whether from out of country, or out of province, only about 19% of construction companies across the country say they plan to increase hiring in this sector. Why? The time and effort required to get credentials up to provincial standards, to put in the training time, and the frustrations of dealing with long-distance hiring issues.

What gear is the government's economic engine in? Neutral. The BDC said this last week, and now the Business Data Lab has confirmed it with a dive into their numbers. This means inflation is dropping - still above the Bank of Canada target of 2% at 3.1%, but definitely closer than the 8%+ from summer. Go deeper into the stats with the Local Spending Tracker and the Business Conditions Terminal available at the Business Data Lab.

What about the impact of immigration on the labour pool? There has been a 3% growth in available labour due to immigration this year; wage pressure is dropping but is still too high for the target 2% inflation rate. And if labour concerns are easing, it’s key to note that demand is dropping, which means labour rates are dropping.

Access the Business Data Lab's complete Q4 Report.